Insurance is a crucial component of financial planning, offering protection against unexpected losses and ensuring financial security. It is a legal agreement where an insurance company provides financial compensation to a policyholder against specific losses, damages, or risks, in exchange for regular payments known as premiums. Insurance helps to mitigate financial difficulties arising from unforeseen events such as accidents, illnesses, or natural disasters.

What is Insurance?

Insurance is a contract between a policyholder and an insurance company, where the insurer agrees to provide financial compensation for specific losses or damages in exchange for a premium. This arrangement helps individuals and businesses manage risks and protect themselves from potential financial hardships. Insurance acts as a safety net, providing financial coverage in the event of unforeseen circumstances, whether you’re protecting your business, property, life, or health.

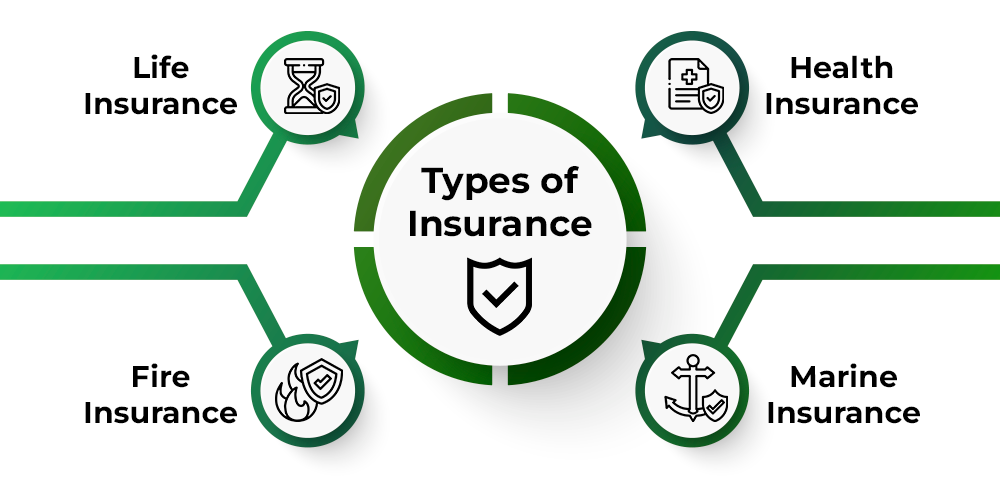

Types of Insurance

There are various types of insurance policies designed to cater to specific needs. The two main categories are life insurance and general insurance.

Life Insurance: Provides financial compensation if the policyholder passes away during the policy term. It ensures the family’s financial security and can cover debts, living expenses, and future goals. Types of life insurance include:

- Term Insurance: Provides coverage for a specific period, covering only death benefits. It is the cheapest option compared to other life insurance plans.

- Whole Life Insurance: Offers coverage for the policyholder’s entire life, covering only death benefits. Premiums are more expensive.

- Unit Linked Insurance Plan (ULIP): Combines insurance and investment, offering both life insurance coverage and investment in the market.

- Endowment Plan: Offers life cover and savings, providing a lump sum amount upon the policyholder’s demise or at the end of the policy term.

- Child Insurance Plan: Designed to provide financial security for a child’s future, covering educational expenses, marriage, and other significant life events.

- Retirement Plan: Provides a regular income during retirement and death benefits.

- Money-Back Policy: Provides returns after a predetermined period, with the sum assured plus bonuses paid upon maturity.

- Term Insurance with Return of Premium (TROP): Offers comprehensive coverage and pays back the premiums if the insured survives the policy term.

General Insurance: Covers aspects of life other than life itself, including health, property, and other assets. Types of general insurance include:

- Health Insurance: Covers medical expenses due to illnesses, accidents, or hospitalization. It includes surgeries, medicines, and preventive healthcare. Different types include individual plans, family floater plans, senior citizen plans, and critical illness plans.

- Property Insurance: Protects physical assets like homes, offices, or vehicles against natural and man-made damages. Examples include home insurance and auto insurance.

- Home Insurance: Provides financial coverage for damage to a home from disasters, protecting against theft, flood, fire, and earthquakes.

- Motor Insurance: Provides financial security for vehicles against physical damages and third-party liabilities. It is mandatory for vehicles in India and includes options for two-wheelers, cars, and commercial vehicles.

- Travel Insurance: Covers unforeseen events during travel, such as trip cancellations, lost luggage, or medical emergencies. It offers single-trip, multi-trip, and area-specific plans.

- Fire Insurance: Compensates for damage caused by accidental fires, valid for one year and renewable annually.

- Business Insurance: Covers risks like property damage, liability, or employee-related issues. Examples include Commercial General Liability (CGL) insurance and marine insurance.

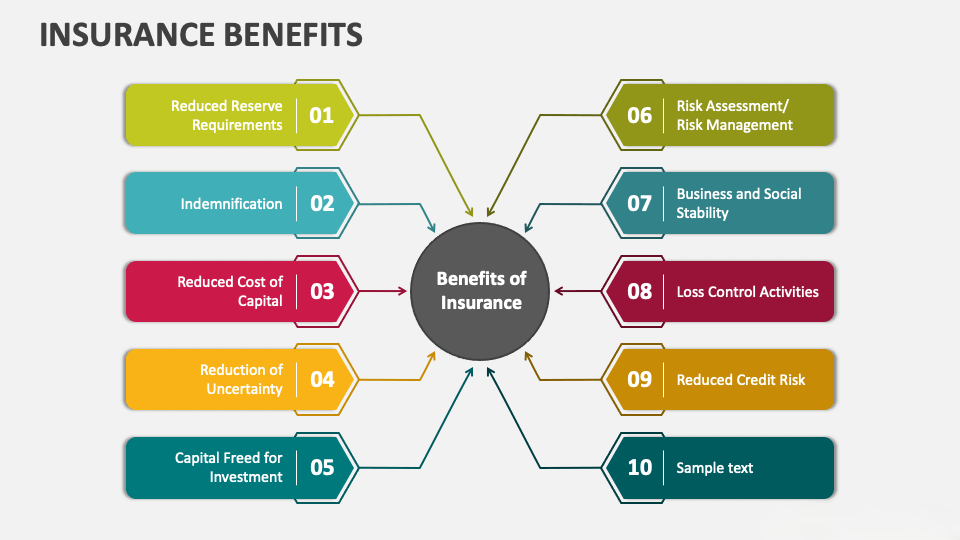

Benefits of Insurance

Insurance offers numerous benefits, extending beyond mere financial security. It provides peace of mind and mitigates risks. The key benefits include:

- Financial Security: Insurance provides a safety net against unexpected financial losses due to accidents, illnesses, or disasters.

- Peace of Mind: Knowing you are protected against potential risks reduces stress and provides peace of mind.

- Risk Mitigation: Insurance helps manage and mitigate various risks, ensuring that unforeseen events do not lead to financial ruin.

- Tax Savings: Certain life and health insurance plans offer tax benefits, helping you save on taxes while securing your future.

- Business Continuity: Business insurance protects against property damage, liability, and employee-related issues, ensuring business continuity.

- Travel Protection: Travel insurance covers losses during travel, including trip cancellations, medical emergencies, and lost baggage.

- Long-Term Security: Life insurance and retirement plans provide long-term financial security for your family and your future.

Importance in Financial Planning

Insurance is an integral part of financial planning, providing a safety net against unforeseen events that could disrupt your financial stability. Here’s why it is important:

- Protection Against Uncertainty: Life is unpredictable, and insurance protects against potential financial losses from unexpected events.

- Securing Future Goals: Insurance ensures that your financial goals, such as children’s education or retirement, remain on track even in adverse situations.

- Estate Planning: Life insurance can be used as a tool for estate planning, ensuring a smooth transfer of assets to your beneficiaries.

- Debt Management: Insurance can help cover outstanding debts in case of unforeseen events, protecting your family from financial burden.

- Promoting Savings and Investment: Certain insurance plans encourage savings and investment, helping you build a corpus for future needs.

Also Read : Understanding Pet Insurance: Coverage, Costs, And Benefits Explained

Conclusion

Insurance is an indispensable tool in financial planning, offering protection against a wide range of risks and ensuring financial security. Understanding the different types of insurance and their benefits can help you make informed decisions and create a robust financial plan that protects you and your loved ones from life’s uncertainties. From life and health insurance to property and travel coverage, choosing the right insurance policies can provide peace of mind and safeguard your financial future.